What's the trend

for controlling costs?

for controlling costs?

Healthcare costs have increased from

$1.2 trillion to $4 trillion over 20 years.

$1.2 trillion to $4 trillion over 20 years.

Family premiums are up 288%

over 20 years.

over 20 years.

Earnings have increased 103%

and inflation has risen 73%.

66% of bankruptcies are related to medical debt.

and inflation has risen 73%.

66% of bankruptcies are related to medical debt.

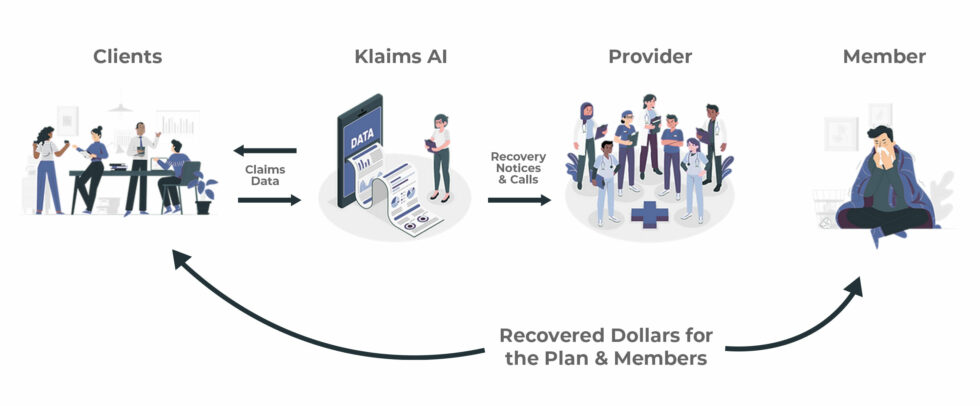

$325 billion is lost to medical overbilling

and fraud each year.

and fraud each year.

U.S. Department of Health & Human Services found that 22% of claims were paid improperly.

ERISA Risks:

Plan administrators and fiduciaries are ultimately responsible for protecting the plan from overbilling, fraud, waste, and abuse.